tesla tax credit 2021 colorado

In short this tax credit previously allowed homeowners that installed solar panels on their homes to deduct 30 of their total solar installation costs from their federal tax liability but after 2020 that deduction amount has been reduced to 26. For example if you are filing a return for 2018 you must include the credit forms for 2018 with your return.

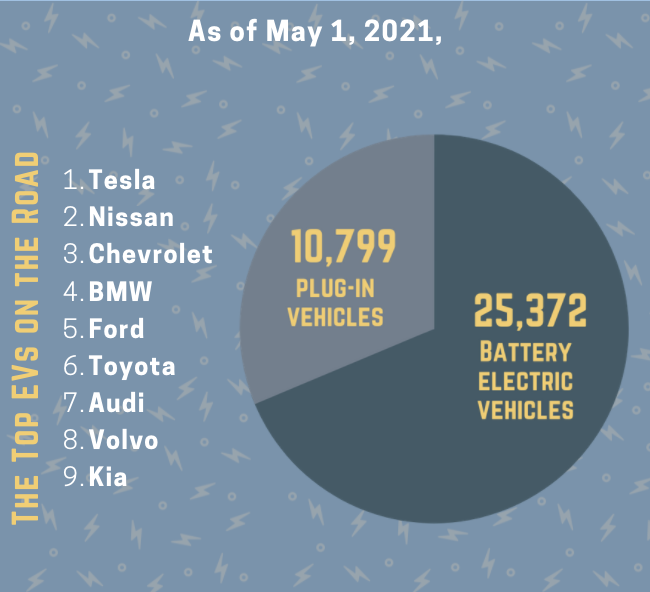

Electric Vehicles In Colorado Report May 2021

Colorados credit for new EV purchases dropped to 4000 in January and will be reduced again next year.

. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. The 2019 and 2021 Audi e-Tron also qualifies. Volkswagen is revolutionizing the electric vehicle market with its exciting offering of vehicles based on their innovative Modular Electric Drive.

The 330e has a reduced credit of 5836. The 2021 Tax Credits Will Take Tesla To The Moon Torque News A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels How Much Is A Tesla Prices For Model 3 Model Y And More Electrek Tax Credit For Electric Cars Tax Credits Irs Taxes Electricity New Ev Federal Tax Credit Proposal Could Reintroduce Incentive For Tesla And Gm. That means that the buyer would have to claim the credit when filing taxes the following year.

The 2021 RAV4 Prime plug-in hybrid still has the full 7500 tax credit. Theres some consternation among EV advocates about the. Information on tax credits for all alternative fuel types.

According to Mark Steber chief tax information officer at Jackson Hewitt if we assume only a standard deduction and no other credits a single filer will need an income of 65964 in. Innovative Motor Vehicle Credit Form DR 0617 DONOTSEND DR 0617 071321 COLORADO DEPARTMENT OF REVENUE TaxColoradogov Innovative Motor Vehicle Credit and Innovative Truck Credit Tax Year 2021 Instructions Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying. Federal tax credits of up to 7500 are still available for most EVs though Tesla met its max at the end of last year and General Motors phases out by April.

112020 112021 112023 112026 Electric or plug-in hybrid electric light duty passenger vehicle 5000 4000 2500 2000. 2021 VW ID4 Electric SUV For Sale or Lease in Denver Colorado. This 26 deduction was initially set to step down again to 22 when 2020 turned to 2021.

112017 112020 112021 112023 but prior to. That includes Teslas Powerwall. Be sure to use the form for the same tax year for which you are filing.

On or after January 1 2024. The credits decrease every few years from 2500 during January 2021 2023 to 2000. Thats because Colorados Innovative Motor Vehicle income tax credit currently pegged at 4000 on the purchase of a new plug-in hybrid or all-electric vehicle will drop to 2500 in 2021.

Some dealers offer this at point of sale. The 2021 Volkswagen ID4 First Pro and Pro S versions qualify. Electric-Vehicle Tax Credit Colorado.

To qualify for the Federal Tax Credit in a particular year the eligible. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

Colorado Electric Vehicle Tax Credit. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan. January 1 2020 to December 31 2022.

If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. Credit Amounts for Vehicles Leased by Transportation Network Companies Tax year beginning on or after. Order your 2021 VW ID4 today starting at 31190 41190 MSRP less 10000 in Federal 7500 and Colorado 2500 tax credits.

If filing by paper visit the Credits Subtractions Forms page to download the forms andor schedules needed to file for the credits listed below. A few 2021 Mercedes Benz models like the X5 xDrive45e 330e and the 330e xDrive qualify for the credit. If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit.

Likewise the credit for leasing an EV will decrease to 1500 from the current 2000. This is crystal clear in the actual tax document found here. You could also be eligible for a tax credit of 5000 for buying or converting a vehicle to electric or 2500 for leasing a.

January 1 2023 to December 31 2023. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. Once you sign it over to a dealer that decides to accept the option its theirs you forfeit the credit and legally cannot take it back in any case and they must give you the credit instantly which is fantastic.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Updated March 2022. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

Beginning on January 1 2021. Tax credits are as follows for vehicles purchased between 2021 and 2026. Colorado offers a tax credit of up to 4000 for purchasing a new EV and 2000 for leasing one.

Innovative Motor Vehicle and Innovative Truck Credits for Tax Years 2017-2021 Although Tesla could claim the credit on behalf of the buyer and apply it to the purchase my understanding is that they dont do that at present. The incentive amount is equivalent to a percentage of the eligible costs. Both the state and the federal government have tax credits that you can take advantage of when purchasing an electric vehicle.

The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit. The rate is currently set at 26 in 2022 and 22 in 2023.

Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed.

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Latest On Tesla Ev Tax Credit March 2022

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Tesla Sees 1st Ever Annual Profit But Misses Estimates Daily Sabah

Ev Incentive Hike Faces Tortuous Path Through Congress Forbes Wheels

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

New Ev Federal Tax Credit Proposal Could Reintroduce Incentive For Tesla And Gm Models News The Fast Lane Car

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Best Electric Cars For Range Forbes Wheels

Electric Vehicles In Colorado Report May 2021

New 2021 Tesla Model S Plaid For Sale In Colorado Springs Co 5yjsa1e69mf441514

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek